How To Safeguard Yourself from Frauds

Identity theft occurs when someone utilizes your personal information without your permission. It has an increasing impact on a significant number of people each year.

Identity fraud is a frequent action that follows identity theft. The theft of an individual’s identity or personal information is theft. Identity fraud progresses when the thief uses your information to open an account, make a transaction, or obtain a loan.

Your financial stability depends on keeping your personal information secure because it is a valuable resource. Discover safety tips, popular scams to avoid, and what to do if you become a victim of identity theft.

Safeguarding your Online Accounts

Where it is available, enable multi-factor authentication to secure your online accounts, including email.

Using identity authentication, you may check if someone is who they claim to be, which can help eliminate fraud. Using multi-factor authentication (MFA), which consists of many layers of identity authentication data, lowers the risk of fraud, fosters trust, and enables organizations to interact with customers more securely.

You can prevent data breaches by using a strong password with at least eight characters, upper- and lowercase letters, at least one number, and a symbol. Utilizing unique passwords for each online account, such as a social network, email, and financial account, and mixing various passphrases that are easy for you to remember but challenging for others to figure out.

Don’t share private information on social media; make sure to only log into your accounts from safe websites.

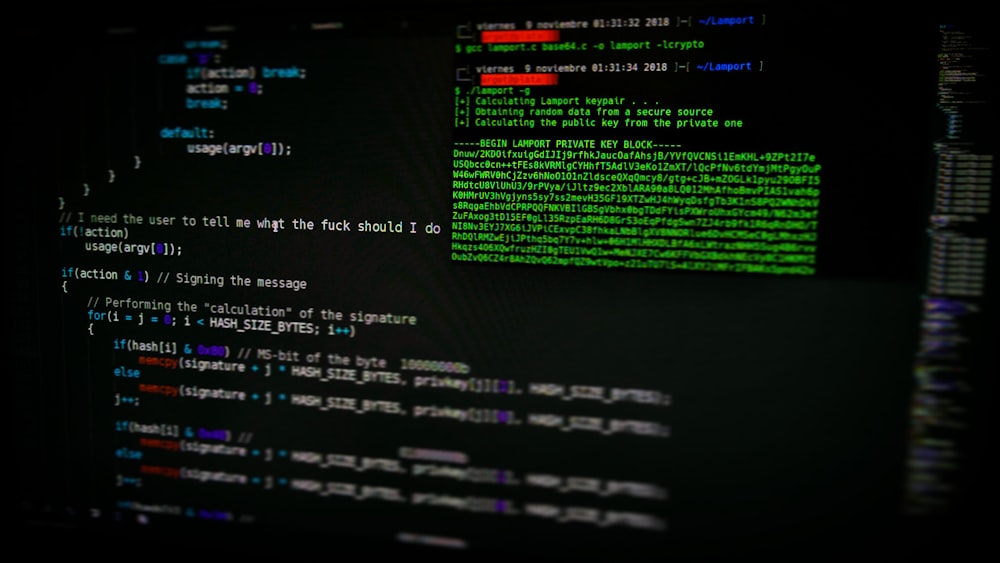

Guarding Your Computer

Be cautious of communications that appear to be important when you are exploring the internet. Neither click on them nor dial the number they offer. No reliable business will call and assert that a virus is on your machine.

Some websites, including those for music, games, movies, and sexual content, may attempt to install spyware or viruses without your awareness. Be mindful about opening attachments or links in emails that include spelling or formatting issues. Viruses or malware can be present.

Maintain an updated operating system and make sure you have anti-virus software installed. Never allow remote access to anyone’s computer.

Regularly Check Your Credit and Bank Accounts

Monitoring your accounts can help you spot any instances of potential fraud as soon as they occur, allowing you to start minimizing any potential harm. Regular online banking users may be more likely to notice something that doesn’t seem correct. You can set up text message alerts for suspicious transaction notifications and use your bank’s mobile app regularly. Call the bank or creditor immediately if you see anything strange.

The Privacy Settings on your Social Media Accounts

The number of identity thieves now stealing people’s identities through social media is fast rising, and it is rife with personal information. It’s crucial to use caution while posting things online.

In your social media settings, you can set your birthdate, place of employment, and current location to private or only visible to friends. Doing this prevents strangers from having simple access to your personal data.

Do a Credit Report Pull

Reviewing your three credit reports regularly—at least once a year—will help ensure that any early signs of fraud or identity theft are discovered. One of these can be a report account you never created. After a brief review, your accounts will be confirmed as accurate and up to date. Check with your creditors or other institutions to see whether they offer free access to your credit score or sign up for a free service. A score that fluctuates unexpectedly could indicate a problem.

Identify Spoofing

Fraudsters utilize spoofing to trick their victims into thinking they are speaking with reliable individuals, businesses, or organizations. The following are the primary spoofing techniques employed by scammers:

- Caller ID fraud

Fraudsters can alter the phone number on the call display by calling or texting. The legitimate phone numbers of government, financial, law enforcement, and service organizations can be displayed by con artists.

- Spoofing emails

Fraudsters can alter the sender’s email address, like caller ID spoofing, to lead you to assume that the email you are getting is coming from a reliable source.

- Website fraud

Fraudsters will design fake websites that appear genuine. The fraudulent websites may pose as a bank, an employer, an investment firm, or a government organization. Fraudsters often utilize a domain or website URL nearly identical to that of a reputable business or institution but with a slight spelling variation.

Never Discard Anything with Your Information on it

Any bills, bank statements, or anything containing your information should be torn up or shredded before disposal. Never leave documents where others can see your name, address, or financial information. Be careful to protect your personal information as much as you can.

Shred or destroy receipts with your credit card information and your name and address printed on them. Identity thieves don’t need a lot of information to be able to duplicate your identity.

Bottomline

Identity theft must be avoided at all costs by staying one step ahead of the criminals. Our uniqueness is a valuable asset. Con artists are, however, completely aware of this. Because it is a valuable resource, protecting your personal information is crucial for preserving your financial stability. We utilize technology and the internet a lot in our daily lives since they simplify many tasks. It’s critical to keep in mind some standard safety precautions when you’re online to safeguard your safety and avoid becoming a victim of cybercrime.