Everything You Need to Know About IFSC Code

A central bank uses the 11-digit Indian Financial System Code (also known as IFSC code) to specifically identify bank branches inside the National Electronic Funds Transfer (NEFT) network. Since online banking is dominating the market, all the banks have enhanced the precision and security of carrying out such transactions. You only need to know the IFSC code of the bank you are transferring money to in order to send money to your near and dear ones from anywhere around the globe. IFSC code is one of the crucial bank information that may be needed while doing financial transactions online. And in case you don’t remember it or may have lost it, you can quickly find it through your bank’s IFSC code finder available on its official website within seconds. In this article, we will walk you through all the necessary details about the IFSC code. So let’s get started!

What is IFSC?

The RBI issues banks and their branches with the IFSC code referred to as the Indian Financial System Code, which is a special 11-character alphanumeric code containing a combination of digits and alphabets. The bank’s name is specified by the first four letters, the fifth character is zero as per the RBI’s mandate to provide room for branch expansion, and the final six characters identify the financial institution branch’s location. Various digital payments, including RTGS, NEFT, and the Centralised Funds Management System (CFMS), require the IFSC code. When moving money between bank accounts, this code is mandatory.

For example, let us look at the IFSC code of the State bank of India, Delhi branch,

SBI IFSC Code Main Branch, New Delhi Branch is SBIN0000691 (required for NEFT, RTGS & IMPS transactions). The bank is located at 11 Sansad Marg, New Delhi 110 001.

Let us understand this SBI IFSC Code – SBIN0000691

- The characters SBIN refer to the State bank of India.

- The fifth digit is zero.

- The last six digits refer to the code of the State Bank of India branch at 11 Sansad Marg, New Delhi 110 001.

Benefits of IFSC code

- Quick fund transfer

Compared to conventional banking methods, digital banking is now far more practical and faster. You avoid having to wait in line for extended periods of time to finish the procedures. As digital transactions are done quickly with the use of the IFSC code, saving a significant amount of time.

- Improved communication

The IFSC Code facilitates rapid and transparent communication between the sender and the recipient. Every time a digital transaction is made, the relevant banks send an immediate SMS or email to both parties.

- Reliable and secure

The IFSC code aids in safe and reliable transactions as it lowers the possibility of any errors or fraud because these codes are used to identify the same bank through which the transaction takes place.

When doing transactions online, the IFSC code aids users in locating the necessary bank as well as the branch..

How to find the IFSC Code of bank?

The IFSC code can be found in various ways:

- By checking on each check leaf as well as on the bank passbook.

- You can also check the list of branches and IFSC codes for banks which are available on the RBI’s official website.

- You can also visit the official website of the bank to know the IFSC code of its specific branch.

Apart from these methods, you can also refer to third-party websites and utilize the SBI IFSC code finder available.

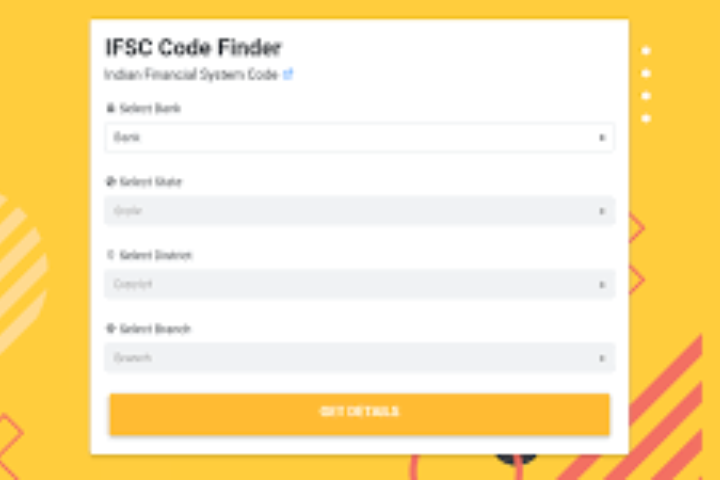

The IFSC code finder is an amazing tool, you only to provide essential information to it, which are;

- The bank name, for example, SBI, HDFC, etc.

- Choose a particular state, e.g., Madhya Pradesh, Maharashtra, etc.

- Choose the district and lastly, the branch, to find the IFSC code.