Everything You Need to Know About The Cross-collateralized loan

While cross-collateralization may sound complex, the idea behind it isn’t as complex as it might sound, even though it can still be complex in practice. Let’s take a closer look.

What is Cross-collateralization?

Collateral simply refers to the collateral you provide for a loan. For a home loan, the collateral is the property that you purchase.

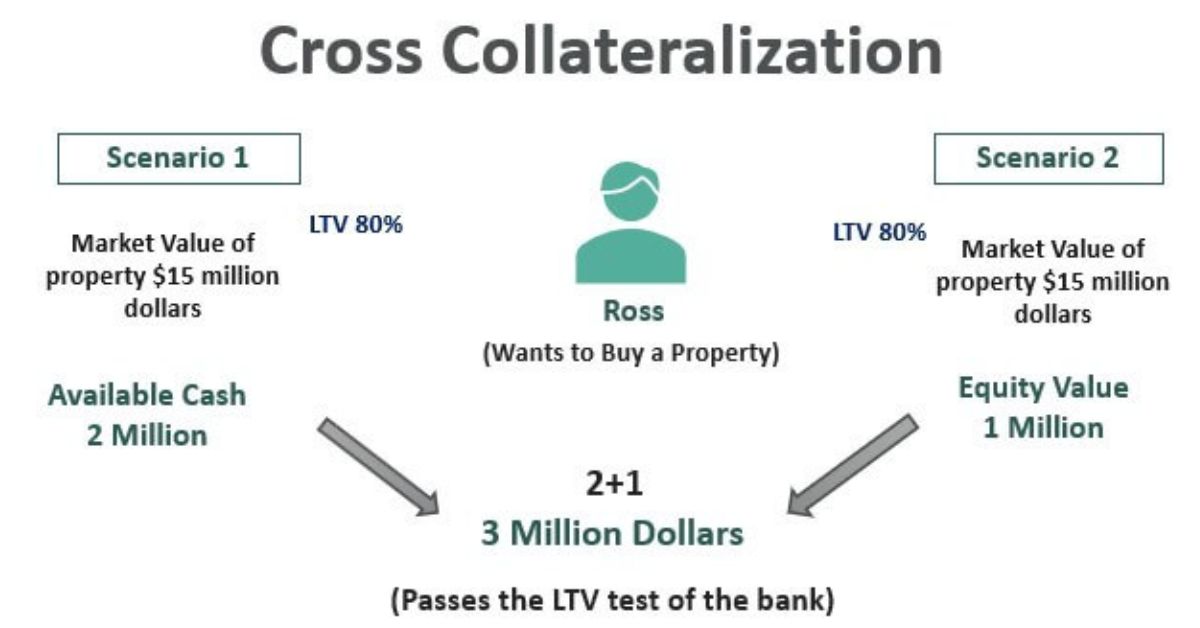

Cross-collateralization means putting up more than one property as security for a loan (or potentially more than one loan). This is why you would do it. Cross-collateralization can be a way to put your home equity to use. According to Peter Corta, a Queensland mortgage broker in Aussie, “cross-collateralization can be an alternative to paying a cash deposit on a second or third property.”

How Does Cross-collateralization Work?

As a hypothetical example to show how cross-collateralization can work, Corta suggests looking at a homeowner who owns a home worth $1 million with a home loan balance of $500,000. Their home equity is now worth $500,000. This equity could be used to finance another property. In this example, we will assume an investment property worth $500,000. “The homeowner now has combined assets of $1.5 million and total debt of $1 million as a result of cross-collateralization,” explains Mr. Corta.

Also, Read- Constructive loans

The equity in the second property may grow, and the property owner might be able to use this equity to finance another property. In this way, cross-collateralization has the potential to help homeowners build a property portfolio.

According to Mr. Corta, homeowners might be able to borrow the entire upfront cost of the second property. And cross-collateralization isn’t limited to investing in a rental property. Cross-collateralization may be an option if your goal is to purchase a vacation home.

Is Cross-collateralization Legal?

Cross-collateralisation is entirely legal, and Corta says it can be easier than taking out multiple loans with different lenders. It is not the best option for everyone, and it has its own risks and drawbacks.

The Pros and Cons of Cross-collateralized Loan

To decide if cross-collateralization is the right strategy for you, it’s important to weigh up its benefits and drawbacks. Here’s a summary of some of the main pros and cons of cross-collateralization.

Potential Benefits

You only have to deal with one lender – cross-collateralization means you use the same lender to fund all your properties. Cross-collateralization can simplify money management and make it possible to pay your fees and manage your account with one lender. This is in contrast to having multiple lenders for home loans.

You may be able to invest sooner – cross-collateralization can mean you don’t necessarily need to wait to save up a deposit to buy an investment property, since your existing home or investment property can be a security deposit.

You might also be interested in- Can you have 2 car loans

Cash savings can be preserved by using the equity in your home to secure an investment property loan. A cash deposit may not be required. This could mean that you don’t need to dip into your personal savings.

Potential Drawbacks

All your loans are with one lender – cross-collateralization is one area where a positive can also be a negative. Although having one lender can streamline your finances, it can also lead to you being locked into a lender that offers lower interest rates if you’re not careful. Multifocus Properties and Finance states that if you wish to refinance later, you will need to have all cross-collateralized properties assessed. This is a cost the lender will likely pass onto you. A negative valuation of one property could cause you to lose you refinance plans.

The amount of equity you can access is limited. You may have lots of equity in your home but not enough equity to be able to use it as security for another property. As Mr. Corta points out, every lender has its own restrictions regarding postcodes, which can limit the loan-to-value ratios that a borrower is allowed to access. He explains that some banks won’t lend over 60% of an apartment in the inner city.

Helpful guide- Loans for traders

There are many issues that can arise when you sell your property. Momentum Wealth points this out: If you sell a cross-collateralized asset, you are fundamentally changing the agreement with your lender. This will change the security of the lender and possibly alter the loan-to-value ratio. You could be asked by the lender to sell any cross-collateralized property because you don’t meet its lending criteria.

You could be asked to pay lenders’ mortgage insurance – if cross-collateralization sees you borrowing a total of more than 80% of your home’s value, the lender will likely ask you to pay lenders’ mortgage insurance. This could limit the amount of home equity that you can use to finance an investment property.

Here are Some Things to Consider

Many property investors prefer to cross-collateralize with multiple lenders than work through one lender. Because they feel that one lender has too much power over their properties, this is why many property investors choose to have multiple lenders.

Despite the potential benefits of cross-collateralization, it’s important to carefully weigh up the risks and seek financial advice to determine the loan structure that best suits your circumstances. You can compare investment home loans with Canstar to get started.

Read also- A PERFECT GUIDE ON BUYING AND SELLING AT PAWNSHOP FINANCIAL SERVICES!